Understand Tax Lien Basics:

A tax lien is a claim against a property for unpaid property taxes. Local county governments sell tax liens to investors to recoup unpaid taxes. When you buy a tax lien, you are a debt investor. In return, you are guaranteed an interest rate or a chance to acquire the property.

All posts

The Power of Persistence in Tax Lien Investments

When it comes to tax lien investments, the phrase “slow and steady wins the race” carries a lot of weight.

Last Look: What Affects Tax Lien and Deed Investing

The bane of success in tax lien and deed investments is information. Staying informed about market trends is essential for

How Government Policies and Tax Law Changes Affect Tax Lien and Deed Investing

Tax lien and deed investing is highly influenced by changes in government policies and tax laws. Whether it is stricter

How Housing Market Stability Affect Tax Lien and Deed Investing

In the world of tax lien and deed investing, the housing market’s stability plays a vital role in determining the

How Interest Rate Fluctuation Affect Tax Lien and Deed Investing

Interest rates play a significant role in shaping the broader real estate market, and tax lien and deed investing is

How Real Estate Market Trends Affect Tax Lien and Deed Investing

Tax lien and deed investing can be a profitable strategy for those looking to enter or expand their presence in

How Economic Cycles Affect Tax Lien and Deed Investing

When it comes to tax lien and deed investing, timing is everything. And one of the biggest factors affecting the

What Affects Tax Lien and Deed Investing?

Tax lien and tax deed investing involves purchasing properties whose taxes have not been paid or properties on auction. It

Legal Considerations and Potential Risks in Tax Deed Investing Pt. 2

In Part 1 of our guide we discussed the basic legal considerations and potential risks involved in tax deed investments.

Legal Considerations and Potential Risks in Tax Deed Investing Part 1

The advantage that tax-deed investments have over other forms of traditional investments is no longer news to you as an

Due Diligence: Researching Properties Before Bidding Part 2

In our last post, we covered the importance of thorough research started in tax deed investing. Purchasing a tax deed

Due Diligence: Researching Properties Before Bidding

When it comes to tax deed investing, the old adage “knowledge is power” couldn’t be more accurate. Before you bid

The Pros and Cons of Investing in Tax Deed

Tax deed investing can be a lucrative venture, but like any investment, it has its pros and cons. As a

The Tax Deed Auction Process: A Step-by-Step Guide Part 2

In Part 1 of our guide, we covered the essential steps to prepare for a tax deed auction, including identifying

Tax Deed Auction Process: A Step-by-Step Guide Pt. 1

Tax deed auctions offer unique investment opportunities for savvy investors. However, navigating the process requires careful preparation and a clear

Introduction to Tax Deeds: What They Are and How They Work Pt 2

In our previous post, we introduced the concept of tax deeds and their role in the real estate market. Now,

Introduction to Tax Deeds

Dear investor, Are you searching for an affordable way to invest in real estate, or are you simply learning about

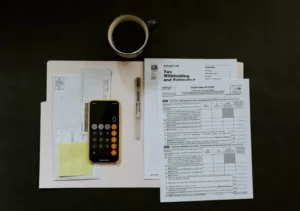

Due Diligence in Tax Lien Investing: Calculating Potential Return on Investment (ROI)

As an investor, understanding and accurately calculating the potential return on investment (ROI) will do you a lot of good.

Due Diligence in Tax Lien Investing: Evaluating the Owner’s Financial Situation

Dear investor, As we continue on the series of due diligence, another major factor to pay attention to as a

Due Diligence in Tax Lien Investing: Ensuring Legal and Regulatory Compliance

Tax lien investing is a complex endeavor that requires a comprehensive understanding of legal and regulatory frameworks. Failing to comply

Due Diligence in Tax Lien Investing: Reviewing Property Taxes and Assessments Due Diligence in Tax Lien Investing

As a tax lien investor, conducting a thorough review of property taxes and assessments is a crucial step in the

Due Diligence in Tax Lien Investing: Ensuring Legal and Regulatory Compliance

Tax lien investing is a complex endeavor that requires a comprehensive understanding of legal and regulatory frameworks. Failing to comply

Due Diligence in Tax Lien Investing: Mastering the County Tax Lien Auction Process

Dear Investor, Let’s talk about the key to success in tax lien investing: understanding the county’s tax lien auction process.

Due Diligence in Tax Lien Investing: Analyzing Property Value and Market Trends

Investing in tax liens can be a lucrative venture, but its success hinges on how well you analyze property and

Due Diligence in Tax Lien Investing: Identifying Property Type and Use

In tax lien investing, not all properties are built the same way. The type of property and its use can

Due Diligence in Tax Lien Investing: Assessing Property Condition for Tax Lien Investing

When it comes to tax lien investing, it is no news that properties can be a mixed bag. Some are

Due Diligence in Tax Lien Investing: Understanding Property Location and Neighborhood

Property location is one of the most important factors to consider when investing in tax liens. It doesn’t matter if

New Series Alert: 10 Must-Know Aspects of Due Diligence in Tax Lien Investing

Hey there, tax lien investors! We have some exciting news for you. We’re kicking off a brand-new series that will

How To Set Your Tax Lien Investing Goals

Zoning in on goals in tax lien investing is all about clearly defining and focusing on specific objectives within your

Why is Yield Important in Tax Lien Investing?

Simply put: yield is your return on investment that you receive when you purchase tax liens. The profit you can

Why Become An Expert in Tax Lien Investing?

Becoming an expert in tax lien investing is a continuous journey. Learning never really stops. Developing expertise requires a combination

How to Win Tax Liens at the Auctions?

When those auction hammers drop, the person who walks away with the property is known as the lien holder. And

How to Assess the Value of The Tax Lien Your investing In

Lean in, properly assessing every single property before bidding on it is absolutely crucial. As an investor, you gotta understand

The Unique Challenges of Investing in Tax Liens

Every type of investment comes with its own set of challenges, and tax lien investing is no exception. We’re talking

How To Time Your Tax Lien Investing for the best returns

You know, when it comes to investing in tax liens, timing is everything. It’s not just about understanding market trends

Tax Lien Investing Strategies

Strategy development in tax lien investing is crucial. It involves creating a plan to maximize returns from investments while minimizing

What’s a Tax Lien Redemption Period

When property taxes are unpaid, the government may place a lien on the property, giving the officials the right to

How to Make Quick Decisions When Investing In Tax Liens

In tax lien investments, auctions are used to determine which investor gets the right to pay the delinquent taxes on

How to Diversify Your Tax Lien Portfolio

Portfolio diversification is an investment strategy. It involves spreading your investments across various properties and locations in your portfolio. This

Effective Outreach Strategies When Investing In Tax Liens

For any investor who wants to succeed, effective outreach is not negotiable. Through outreaches, you can expand your network, gain

How To Find Niche Markets When Investing In Tax Liens

Exploring niche markets as an investor may provide you with many opportunities. But understanding the dynamics of the areas or

How Market Conditions Effect Tax Lien Investing

The success of tax lien investments may differ from one jurisdiction to another due to the local real estate market

Tax Lien Investing Liquidity

Liquidity is a crucial factor to consider when investing in a tax lien. It is important to know that tax

What You Need To Know When Investing In Tax Liens

In the dynamic world of tax lien investing, knowledge is a formidable asset that can propel you towards success. When

Understanding each Jurisdiction when investing in Tax Liens

Tax lien investing requires a deep understanding of the legal landscape, as the rules and regulations governing this investment strategy

How To Earn Passive Interest with Tax Liens

How can earning interest on overdue taxes possibly be a good investment? Well, by purchasing tax liens, investors can earn

How to Find High Returns with Tax Lien Investing

Traditional investment options may, at best, provide modest returns. But tax lien investing on the other hand can literally make

Tax Lien Investing – A Local Government Strategy To Help Counties Generate Revenue

You’re not just bidding on properties – you’re dealing with the intricacies of local government regulations and compliance requirements. So

How To Foreclose on Tax Lien and Tax Deeds

As a tax lien investor, you hold a powerful card – the potential to foreclose on a property if the

How To Get Educated in Tax Lien investing

Quality and continuous education is the difference between tax lien investors that succeed and those who struggle. Staying informed about

How to Do Due Diligence When Investing in Tax liens

When venturing into tax lien investing, thorough due diligence is the key to laying the foundation for making informed investment

How to Collect Your Returns in Tax Lien Investing

When you win a tax lien, the property owner owes you for those unpaid taxes plus a bit of interest.

Tax Lien Bidding Strategies

When venturing into tax lien auctions, the bidding process can seem complex. As an investor, it’s vital for you to

How To Participate in Tax Lien Auctions

Tax liens are typically sold through auctions conducted by local governments. These auctions can be in-person or online. Investors bid

Coming Soon: The Tax Lien ABCs Series

We’re launching a new series focused on tax lien investing: “Tax Lien ABCs.” This series will cover everything from the

A Beginner’s Guide To Tax Liens

When a property owner fails to pay their taxes, the county government steps in and puts a lien on the

Diversification In Tax Liens: What You Need to Know

Investing in tax liens is as safe as it gets, when it comes to real estate. But like any investment,

Foreclosure:

If the property owner doesn’t pay within a specified period, you have the option to foreclose on the property. However,

Collecting Returns

Collecting returns in tax lien investing involves a combination of patience and strategic monitoring. As tax lien investors, we wait

Risks and Considerations:

Awareness of the risks associated with tax lien investing is crucial for making informed decisions. Here are some key risks

Research Local Laws:

Tax lien laws vary by location. Investors must research and understand the specific rules in the area they’re interested in.

Winning the Lien

If you win a tax lien, you essentially become the “lien holder,” and the property owner owes you the unpaid

Participate in Auctions

Participating in tax lien auctions requires a strategic and informed approach. The bidding processes will vary, so we must be

Budget and Due Diligence

Budgeting and due diligence are vital to a successful tax lien investment strategy. Let’s break down these steps: Set a

Identify Auctions

Finding the right auctions is a crucial step in tax lien investing. These auctions can be in-person or online. A

Understand Tax Lien Basics:

A tax lien is a claim against a property for unpaid property taxes. Local county governments sell tax liens to

The Coming Financial Crisis

WILL THIS REPLACE THE U.S. DOLLAR? Can you believe this? Inflation is so high that people are creating new currencies!

Active vs. Idle Tax Lien Investing: What You Need to Know

Investing in the American real estate market can be a lucrative proposition for those willing to take the time to

Judicial Tax Lien Foreclosures

Many of the topics related to tax lien certificates are covered in the real estate education courses that prospective realtors

Tax Lien Investing: Risks and Considerations

There are always potential risks when you invest in tax liens and deeds. Below we will carefully explain how to

County Property and Real Estate Records

Though many small or rural countries do not have websites, counties make property information available online. This makes research much

What Depreciation Means for Real Estate Investing

What Is Real Estate Depreciation? Real estate depreciation is the process of allocating the cost of a property over its

Rental Properties and Tax Liability

Owning rental properties can be a great way to make money. However, it’s not for everyone. You need patience and

The Importance of A Lawyer in Tax Lien Investing

Tax liens are a great way for real estate investors to increase their income. The question is: how do you

What You Need to Know About Unpaid Property Tax

A property tax lien is a claim placed on property by a government entity as a result of the owner’s

Tax Lien VS Tax Deed Certificate Investors

The kind of investor you are is determined by your resource constraints: the cash you set aside to invest, time

Quiet Title Action: What You Need To Know

A Quiet Title Action is an action filed by the court to settle the title to property. It can be

Short Selling: Tips and Strategies

Short selling is a trading strategy that shortens the lifespan of an asset in order to profit from the difference

Understanding Tax Sale Lists

A tax sale is the sale of a real estate property that results when a taxpayer reaches a certain point

Vacant Land: Pros and Cons

Vacant land is one of the most overlooked and misunderstood real estate investments out there. Many people shy away from

Tax Liens For Beginners: What You Need to Know

If you need to diversify your investment portfolio and have a solid understanding of how real estate works, tax lien

Understanding Online Tax Lien Auctions

Every state has specific rules governing how tax liens are processed. To participate, one must first know the county you

Wholesaling 101

As of 2022, wholesaling is still one of the most underrated ways to get into real estate with little to

Understanding How to Buy Tax Deeds

Buying tax deeds is not a typical starting point for new investors, but it can be a lucrative investment strategy.

What is A Tax Deed Sale?

The tax deed system is extremely similar to the tax lien system, but the investments are offered at another point

How to Profit from Tax Lien Investing

Many real estate investors who thought they knew everything about their chosen sector are surprised to learn about individuals generating

The Importance of Title Insurance

Does title insurance matter? This is a question that many people ask themselves when they are buying or selling property.

Function of Self Directed IRA in Real Estate

A self-directed individual retirement account (SDIRA) is a type of individual retirement account (IRA) that can hold a variety of

Determining What States Sell Tax Liens

Tax lien investing is a major revenue generator for state governments. For this reason, each state has its own set

Investor Tips: Due Diligence in the Information Age

In the world of investing, due diligence can be described as the collection of good practices related to the investigation

Advantages & Disadvantages of Tax Lien Investing

What is a Tax Lien? A tax lien investment is a passive investment that you can make through your state

Tax Lien Certificates: What You Need to Know

The winner of the tax lien certificate receives the right to collect all delinquent real estate taxes on a property

Using Real Estate to Fuel Retirement Goals

It is not surprising that real estate professionals are looking at retirement accounts as new sources of funding, considering the

Active vs. Idle Tax Lien Investing: What You Need to Know

Investing in the American real estate market can be a lucrative proposition for those willing to take the time to

Tax Lien Investing: Income Stream to Build Wealth

Tax Liens: The Basics The tax lien investing industry is booming. Tax lien investing is a strategy that can help

Fix and Flip: Essential Tips

1. Know the Local Market Understanding the local market will be your key to profitability. Knowing what properties are selling

District of Columbia Tax License

Sale Type: Tax Lien Certificates Interest Rate: 18% Bid Method: Premium Bid Redemption Period: 6 Months Sale Date(s): July State

Massachusetts Redemption Deeds

Sale Type: Redeemable Tax Deed Interest Penalty: 16% Bid Method: Varies Redemption Period: 6 Months Statute Section(s): General Laws Section

New Hampshire Deeds

Sale Type: Tax Deed Bid Method: Bidding Premium Sale Date(s): Varies State Statute(s): Title V, CH 80 Over-the-Counter: www.nh.gov Sales

North Dakota Deeds

Sale Type: Tax Deed Interest Rate: N/A Bid Method: Premium Bid Redemption Period: N/A Sale Date(s): November State Statute(s): T57C28

CONTACT US

Get in touch

Thank you for looking to reach out. Please fill out the contact form with your details and enquiry, and we will get back to you as soon as possible.